Data Privacy Notice

We take your privacy very seriously and we ask that you read this privacy notice carefully as it contains important information on who we are, how and why we collect, store, use and share personal data, your rights in relation to your personal data and on how to contact us and supervisory authorities in the event you have a complaint.

Italicised words in this privacy notice have the meaning set out in the Glossary of Terms at the end of this document.

Who we are

Our website address is: https://www.bailey-fs.co.uk/

Bailey Financial Services collects, uses and is responsible for certain personal data about you. When we do so we are required to comply with data protection regulation and we are responsible as a data controller of that personal data for the purposes of those laws. When we mention “Bailey Financial Services, “we”, “us” or “our” we are referring to Bailey Financial Services (Preston) Ltd.

Bailey Financial Services is a company registered in England and Wales (company number 6380493 whose registered office is at Thomas House, Meadowcroft Business Park, Pope Lane, Preston, PR4 4AZ. Bailey Financial Services is authorised and regulated by the Financial Conduct Authority. Bailey Financial Services Financial Services Register number is 478376.

We provide you with intermediary services with regard to independent financial advice.

The personal data we collect and use

In the course of providing our service to you we may collect the following personal data when you provide it to us:

- contact information

- identity information

- financial information

- employment status

- lifestyle information

- health information

- details of any vulnerability

- details of your dependents and/or beneficiaries under a policy (If you are providing information about another person we expect you to ensure that they know you are doing so and are content with their information being provided to us. You might find it helpful to show them this privacy notice and if they have any concerns please contact us in one of the ways described below.)

- product details

Information collected from other sources

We also obtain personal data from other sources in the course of providing our intermediary services.

Where we obtain this information from another party it is their responsibility to make sure they explain that they will be sharing personal data with us and, where necessary, ask permission before sharing

information with us.

The personal data we obtain from other sources may include the following:

- From lenders and/or product providers:

– product details

How we use your personal data

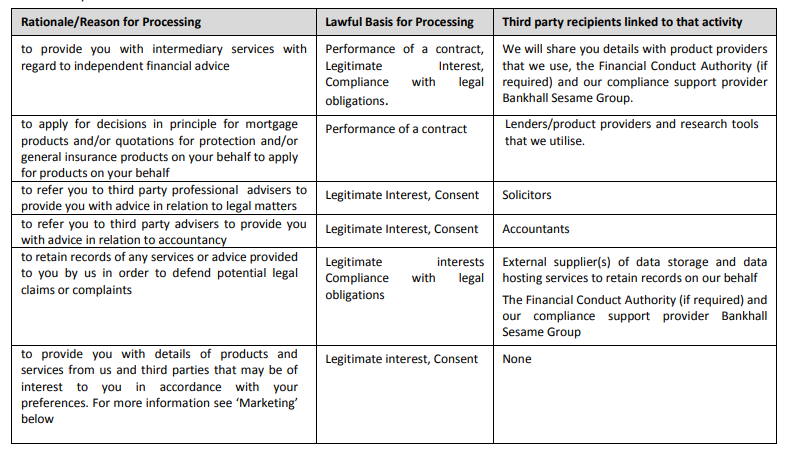

The below table sets out:

- how we use your personal data

- the lawful bases upon which we collect and use your personal data

- who we routinely share your personal data with

Special category data

Certain types of personal data are considered more sensitive and so are subject to additional levels of protection under data protection legislation. These are known as ‘special categories of data’ and include data concerning your health, racial or ethnic origin, genetic data and sexual orientation. Data relating to

criminal convictions or offences is also subject to additional levels of protection.

We may process:

- health information and lifestyle information when providing intermediary services in relation to a

protection insurance product. - Criminal conviction or offence information when providing intermediary services in relation to a

general insurance product. - Processing for the purpose of advising on, arranging or administering non- insurance contracts.

In addition to the lawful basis for processing this information set out in the above table, we will be processing it either (i) for the purpose of advising on, arranging or administering an insurance contract or (ii) for the establishment, exercise or defence of legal claims.

In the course of our activities relating to the prevention, detection and investigation of financial crime, we may process criminal conviction or offence information. Where we do so, in addition to the lawful basis for processing this information set out in the above table, we will be processing it for the purpose

of compliance with regulatory requirements relating to unlawful acts and dishonesty.

Marketing

We may use personal data we hold about you to help us identify, tailor and provide you with details of products and services from us that may be of interest to you. We will only do so where we have a legitimate business reason to do this and will do so in accordance with any marketing preferences you

have provided to us.

In addition, where you provided your consent, we may provide you with details of products and services of third parties where they may be of interest to you.

You can opt out of receiving marketing at any time. If you wish to amend your marketing preferences please contact us:

By phone: 01772 7500558

By email: mail@bailey-fs.co.uk

By Post: Slater House, Meadowcroft Business Park, Pope Lane,

Preston PR4 4BA

[In addition, you can opt out of receiving marketing at any time by clicking the ‘unsubscribe’ link at the bottom of every email.]

Whether information has to be provided by you, and if so why

We will tell you if providing some personal data is optional, including if we ask for your consent to process it. In all other cases you must provide your personal data in order for us to provide you with intermediary services.

How long your personal data will be kept

We will hold your personal data for differing periods of time depending upon the reason we have for processing it. These retention periods are set out below.

Type of Record

We will hold electronic records pertaining to the advice that we have provided to you.

Retention Period

The minimum retention period is generally 5 years; we do however reserve the right to retain information for longer than the statutory periods as we may need the information to defend a future claim against us.

For Pension Transfer advice the information would be held indefinitely.

Transfer of your information out of the EEA

We will not transfer your personal data outside of the European Economic Area or to any organisation (or subordinate bodies) governed by public international law or which is set up under any agreement between two or more countries.

You have a right to ask us for more information about the safeguards we have put in place as mentioned above. To learn more, please see ‘Your rights’ below.

Your rights

You have legal rights under data protection regulation in relation to your personal data. These are set out under the below headings:

- To access personal data

- To correct / erase personal data

- To restrict how we use personal data

- To object to how we use personal data

- To ask us to transfer personal data to another organisation

- To object to automated decisions

- To find out more about how we use personal data

We may ask you for proof of identity when making a request to exercise any of these rights. We do this to ensure we only disclose information or change your details where we know we are dealing with the right individual.

We will not ask for a fee, unless we think your request is unfounded, repetitive or excessive. Where a fee is necessary, we will inform you before proceeding with your request.

We aim to respond to all valid requests within one month. It may however take us longer if the request is particularly complicated or you have made several requests. We will always let you know if we think a response will take longer than one month. To speed up our response, we may ask you to provide more detail about what you want to receive or are concerned about.

We may not always be able to fully address your request, for example if it would impact the duty of confidentiality we owe to others, or if we are otherwise legally entitled to deal with the request in a different way.

To access personal data

You can ask us to confirm whether or not we have and are using your personal data. You can also ask to get a copy of your personal data from us and for information on how we process it.

To rectify / erase personal data

You can ask that we rectify any information about you which is incorrect. We will be happy to rectify such information but would need to verify the accuracy of the information first.

You can ask that we erase your personal data if you think we no longer need to use it for the purpose we collected it from you.

You can also ask that we erase your personal data if you have either withdrawn your consent to us using your information (if we originally asked for your consent to use your information), or exercised your right to object to further legitimate use of your information, or where we have used it unlawfully or where we are subject to a legal obligation to erase your personal data.

We may not always be able to comply with your request, for example where we need to keep using your personal data in order to comply with our legal obligation or where we need to use your personal data to establish, exercise or defend legal claims.

To restrict our use of personal data

You can ask that we restrict our use of your personal data in certain circumstances, for example

- where you think the information is inaccurate and we need to verify it;

- where our use of your personal data is not lawful but you do not want us to erase it;

- where the information is no longer required for the purposes for which it was collected but we need it to establish, exercise or defend legal claims; or

- where you have objected to our use of your personal data but we still need to verify if we have overriding grounds to use it.

We can continue to use your personal data following a request for restriction where we have your consent to use it; or we need to use it to establish, exercise or defend legal claims, or we need to use it to protect the rights of another individual or a company.

To object to use of personal data

You can object to any use of your personal data which we have justified on the basis of our legitimate interest, if you believe your fundamental rights and freedoms to data protection outweigh our legitimate interest in using the information. If you raise an objection, we may continue to use the personal data if we can demonstrate that we have compelling legitimate interests to use the information.

To request a transfer of personal data

You can ask us to provide your personal data to you in a structured, commonly used, machine-readable format, or you can ask to have it transferred directly to another data controller (e.g. another company).

You may only exercise this right where we use your personal data in order to perform a contract with you, or where we asked for your consent to use your personal data. This right does not apply to any personal data which we hold or process outside automated means.

To contest decisions based on automatic decision making If we made a decision about you based solely by automated means (i.e. with no human intervention), and the decision made by us produces a legal effect concerning you, or significantly affects you, you may have the right to contest that decision, express your point of view and ask for a human review. These rights do not apply where we are authorised by

law to make such decisions and have adopted suitable safeguards in our decision making processes to protect your rights and freedoms.

You can contact us for more information

If you are not satisfied with the level of information provided in this privacy notice, you can ask us about what personal data we have about you, what we use your information for, who we disclose your information to, whether we transfer it abroad, how we protect it, how long we keep it for, what rights you

have, how you can make a complaint, where we got your data from and whether we have carried out any automated decision making using your personal data.

If you would like to exercise any of the above rights, please:

- email or write to Michael Bailey at Bailey Financial Services, Slater House, Meadowcroft Business Park, Pope Lane, Preston PR4 4BA

- let us have enough information to identify you, e.g. name, address, date of birth;

- let us have proof of your identity and address (a copy of your driving licence or passport and a recent utility or credit card bill); and

- let us know the information to which your request relates.

Keeping your personal data secure

We have appropriate security measures in place to prevent personal data from being accidentally lost, or used or accessed in an unauthorised way. We limit access to your personal data to those who have a genuine business need to know it.

Those processing your information will do so only in an authorised manner and are subject to a duty of confidentiality.

We also have procedures in place to deal with any suspected data security breach. We will notify you and any applicable regulator of a suspected data security breach where we are legally required to do so.

Our supervisory authority

If you are not happy with the way we are handling your information, you have a right to lodge a complaint with the Information Commissioners Office. It has enforcement powers and can investigate compliance with data protection regulation (www.ico.org.uk). We ask that you please attempt to resolve any issues with us before the ICO.

How to contact us

Please Michael Bailey if you have any questions about this privacy notice or the information we hold about you.

If you wish to contact Michael Bailey, please send an email tomail@bailey-fs.co.uk or write to Bailey Financial Services, Slater House, Meadowcroft Business Park, Pope Lane, Preston PR4

4BA.

Glossary of Terms

we, us or our

Bailey Financial Services (Preston) Ltd a company registered in England and Wales company number 6380493 and having its registered office at Thomas House, Meadowcroft Business Park, Pope Lane, Preston , PR4 4AZ.

contact information

these are details that can be used to contact a person, including title, first name, surname, personal telephone number, fax, email address, home address, country, postcode or city of residence. This may also include work contact information such as work telephone number, fax, work email and work address

data controller

means a natural or legal person (such as a company) which determines the means and purposes of processing of personal data. For example, we are your data controller as we determine how we will collect personal data from you, the scope of data which will be collected, and the purposes for which it will

be used in the course of us providing you with intermediary services

data protection regulation

applicable data privacy and protection laws

employment status

this is information about your work, if you are employed, self-employed, unemployed, a student or on job seeker allowance

FCA

the Financial Conduct Authority, being the independent watchdog that regulates financial services

financial information

this is information relating to your financial status, including salary/income, outgoings/expenditure, tax rate and P60

health information

this is information relating to your medical history, including symptoms, diagnoses, procedures and outcomes, as well as information about your height and weight. This could include previous and current or persistent medical conditions and family medical history

identity information

this is any information that can be used to distinguish a person or verify their identity,such as name, date of birth, place of birth, gender, marital status, national identity card/number, passport, drivers licence and national insurance number

intermediary services

these are the services we provide to you in relation to the products, which may include: mortgage, protection, pension, investment lenders a mortgage lender (for a list of current lenders which we work with, please contact us – see How to contact us above)

lifestyle information

this includes both work and leisure behaviour patterns. Most relevant to your products may be your smoker status, alcohol consumption, health, retirement age and exercise habits

product

this is an investment, pension, mortgage, protection in respect of which we provide intermediary services to you

product provider

a company which provides investment, pension, protection and/or general insurance products (for a list of product providers which we work with, please contact us – see How to contact us above)

sanction check

information this is information relating to your politically exposed persons (PEPs) status and Her Majesty’s Treasury financial sanctions status, which is recorded to prevent fraud and money laundering

vulnerability

a vulnerable consumer is someone who, due to their personal circumstances, is especially susceptible to detriment, particularly when an advisory firm is not acting with appropriate levels of care. These customers are more likely to suffer severe detriment if something goes wrong. Details of vulnerability fall in to the following categories: health; resilience (financial); life events; and capability (financial knowledge/confidence)